Are you drowning in credit card bills and wondering if there’s a lifeline? Over 77% of American households carry some form of debt, with the average credit card balance reaching $6,501 in 2024. If you’re struggling to keep up with monthly payments or facing collections calls, you’re not alone, and there’s help available.

Debt relief companies have helped millions of Americans reduce their financial burden, with the industry resolving nearly $20 billion in debt in recent years. But with so many options and potential scams out there, choosing the right debt relief partner can feel overwhelming.

Why Finding the Right Debt Relief Company Matters Now More Than Ever

The current economic landscape has pushed many Americans into difficult financial situations. Rising interest rates, increased living costs, and unexpected medical bills have created a perfect storm of debt. According to recent Freedom Debt Relief data, the average borrower enrolling in debt relief programs carries over $26,000 in debt with a FICO score of 599.

Debt relief isn’t just about reducing what you owe; it’s about avoiding bankruptcy, protecting your remaining credit, and getting tools to rebuild your financial life. However, not all debt relief companies are created equal. Some charge excessive fees, make unrealistic promises, or use high-pressure tactics that leave you worse off than when you started.

What You Need to Know Before Choosing a Debt Relief Company

The Reality of Debt Relief

Debt relief (also called debt settlement) involves negotiating with creditors to accept less than the full amount you owe. It sounds appealing, but there are important trade-offs:

✓ Potential Benefits:

- Reduce total debt by 30-50% on average

- Avoid bankruptcy and its 7-10 year credit impact

- Single monthly payment instead of juggling multiple bills

- Complete programs in 24-48 months typically

✗ Important Considerations:

- Your credit score will drop initially (often significantly)

- Forgiven debt over $600 is taxable income

- Creditors aren’t required to negotiate—some may sue

- Late payment fees and interest continue accumulating

- Programs cost 15-25% of enrolled debt plus account fees

Who Should Consider Debt Relief?

Debt relief makes the most sense if you’re:

- Already behind on payments or struggling to pay minimums

- Carrying $7,500+ in unsecured debt (credit cards, medical bills, personal loans)

- Unable to qualify for debt consolidation loans due to low credit

- Spending over 50% of monthly income on debt payments

- Facing 5+ years to repay debt at current rates

- Considering bankruptcy as your only alternative

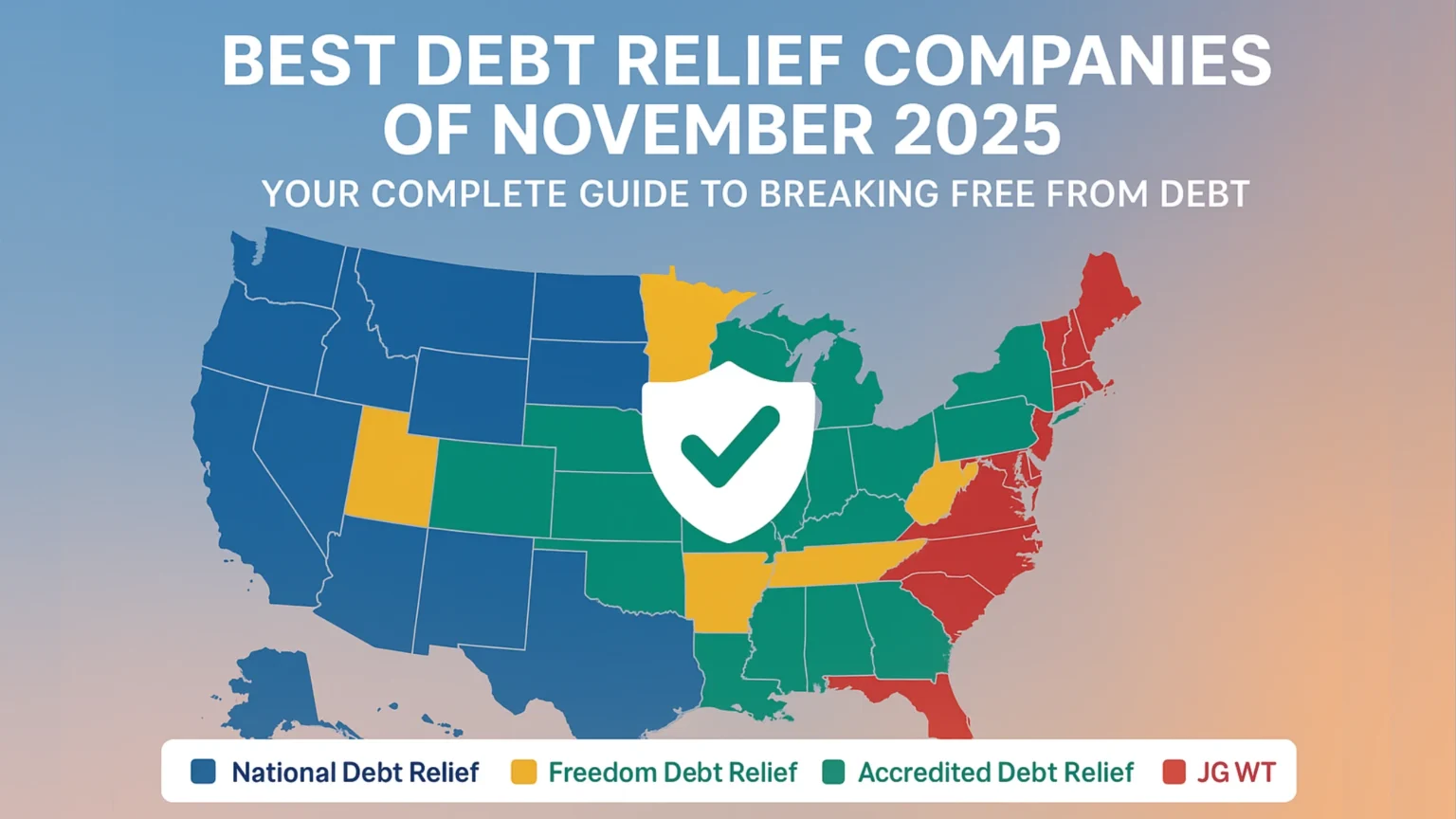

Our Top 7 Best Debt Relief Companies of November 2025

We researched 26 debt relief companies, analyzing over 1,500 data points, including fees, customer satisfaction ratings, accreditations, legal history, and actual settlement results. Here are our top picks:

1. National Debt Relief — Best Overall Debt Relief Company

Rating: 4.8/5 ★

Why We Chose It: With over 1.2 million clients helped and $1 billion+ in debt resolved, National Debt Relief offers the most comprehensive debt relief platform we reviewed.

Key Features:

- Minimum Debt: $7,500

- Fee: 15-25% of enrolled debt

- Timeline: 24-48 months (average 34 months for completion)

- Availability: 47 states plus DC, Puerto Rico, Guam, and Virgin Islands

- Customer Support: 7 days/week with 24/7 online dashboard access

What Sets Them Apart: National Debt Relief’s “Whole Human Finance” approach goes beyond just settling debt. You’ll get access to credit counseling, bankruptcy guidance, and even debt consolidation loan options through partners. They’re accredited by the Better Business Bureau (A+ rating), the International Association of Professional Debt Arbitrators (IAPDA), and the Association for Consumer Debt Relief (ACDR).

Real Client Impact: The average National Debt Relief client who completes the program does so 14 months faster than the industry average, getting debt-free in under 3 years.

Best For: Anyone with at least $7,500 in credit card or unsecured debt who wants comprehensive support and proven results.

2. Freedom Debt Relief — Best for Legal Support & Program Cost Guarantee

Rating: 4.5/5 ★

Why We Chose It: Freedom Debt Relief’s unique program cost guarantee and free legal support make them stand out in a crowded market.

Key Features:

- Minimum Debt: $7,500

- Fee: 15-25% of enrolled debt

- Timeline: 24-48 months (average 39 months)

- Availability: 41 states

- Special Feature: If your total settlement cost exceeds your originally enrolled debt amount, FDR refunds you the difference

What Sets Them Apart: Unlike competitors who charge $20-40/month for legal assistance, Freedom Debt Relief includes it at no extra cost. Their network of attorneys helps deal with creditor lawsuits and aggressive collection tactics. Plus, their highly-rated mobile app makes tracking progress easier than most competitors.

Track Record: Over $20 billion in debt resolved since 2002, serving more than 1 million customers.

Important Note: FDR settled a $9.75 million class-action lawsuit in 2024 for Telephone Consumer Protection Act violations from 2017-2018, though they’ve since updated their practices.

Best For: People worried about legal action from creditors or wanting insurance that they won’t pay more than necessary.

3. Accredited Debt Relief — Best for Customer Satisfaction

Rating: 4.86/5 ★

Why We Chose It: Accredited Debt Relief earned the highest customer satisfaction ratings across multiple review platforms (BBB, Trustpilot, and Google Reviews).

Key Features:

- Minimum Debt: $10,000

- Fee: Up to 25% of enrolled debt

- Timeline: 24-48 months

- Availability: 31 states

- Customer Support: 7 days/week (8am-11pm EST weekdays, 8am-10pm EST weekends)

What Sets Them Apart: Every client works with a certified debt specialist to create a personalized plan. Unlike most competitors who focus solely on settlement, Accredited also matches clients with debt consolidation loans when that’s a better fit. Their mobile app (rare in the industry) lets you track everything on the go.

Results: Over $2 billion in debt paid off for clients who completed their programs.

Best For: People who value exceptional customer service and want guidance on whether settlement or consolidation is the right choice.

4. Money Management International — Best for Low Fees & Small Debts

Rating: 4.7/5 ★

Why We Chose It: MMI offers the lowest fees we found (7.5-18% of enrolled debt) and accepts clients with just $2,500 in debt.

Key Features:

- Minimum Debt: $2,500 for settlement; $0 for credit counseling

- Settlement Fee: 7.5-18% of enrolled debt (lowest in industry)

- Debt Management Plan Fee: $0-$59/month (sliding scale based on income)

- Timeline: 24-48 months

- Customer Support: 24/7 phone support

What Sets Them Apart: Founded in 1958, MMI is the oldest and most established company on our list. They offer both debt settlement and credit counseling/debt management plans—the latter helps you pay off full amounts with lower interest rates and no credit damage. Optional legal support through partner Fortress Legal costs just $30/month.

Best For: People with smaller debt amounts, limited budgets, or those who want to explore debt management before committing to settlement.

5. ClearOne Advantage — Best for Dedicated Customer Support

Rating: 4.4/5 ★

Why We Chose It: With over 600 trained certified debt specialists, client relations experts, and negotiators, ClearOne offers personalized attention throughout your journey.

Key Features:

- Minimum Debt: $10,000

- Fee: Not publicly disclosed (contact for quote)

- Timeline: 24-60 months

- Availability: Most states

- Customer Support: 6 days/week with chat support

What Sets Them Apart: ClearOne has helped clients resolve over $3 billion in debt. Every client gets a dedicated team member guiding them through the entire process. While they don’t publicly list fees (a transparency con), their free, no-obligation debt analysis helps you understand all costs upfront.

Best For: People who want hand-holding through the process and don’t mind requesting a custom quote.

6. Pacific Debt Relief — Best for Educational Resources

Rating: 4.5/5 ★

Why We Chose It: Pacific Debt’s impressive library of financial education content helps clients understand not just debt settlement but long-term money management.

Key Features:

- Minimum Debt: $10,000

- Fee: 15-25% of enrolled debt

- Timeline: 24-48 months

- Availability: 41 states plus DC

- Experience: 23 years in business (since 2002)

What Sets Them Apart: Their educational blog and resources cover budgeting, credit scores, and financial wellness in easy-to-understand language. Each client gets a dedicated account manager and can build their payment plan around their actual budget, not a one-size-fits-all formula.

Customer Savings: Most clients save 30-50% on enrolled debt after fees.

Best For: People who want to educate themselves about personal finance while working through debt settlement.

7. JG Wentworth — Best for Depth of Experience

Rating: 4.3/5 ★

Why We Chose It: With 30+ years in financial services and the ability to handle debts up to $100,000, JG Wentworth brings unmatched experience.

Key Features:

- Minimum Debt: $10,000

- Maximum Debt: $100,000

- Fee: 18-25% of enrolled debt

- Timeline: 24-48 months

- Customer Support: 24/7 availability

What Sets Them Apart: JG Wentworth’s long track record means you’re not dealing with a fly-by-night operation. They offer various debt relief options and can handle significantly higher debt amounts than most competitors.

Drawback: Not available in 20 states, and fees run slightly higher than average.

Best For: People with very high debt amounts ($50,000+) who want an established, reputable company.

Understanding How Debt Relief Actually Works: The Process Explained

Step 1: Free Consultation (Week 1)

You’ll discuss your financial situation with a debt specialist. They’ll review:

- Types and amounts of debt you have

- Your monthly income and expenses

- Whether you qualify for their program

- Estimated savings and timeline

Red Flag Alert: Legitimate companies never guarantee specific dollar amounts or promise to eliminate all your debt. Be wary of anyone who does.

Step 2: Enrollment & Account Setup (Week 2-3)

If you decide to move forward:

- You’ll open a dedicated savings account (typically $9-10 setup fee and $9-11/month maintenance)

- Stop making payments to creditors (this is required but damages credit)

- Start making affordable monthly deposits into your settlement account

Step 3: Fund Building & Negotiation (Months 2-12)

While you build up settlement funds:

- The company contacts your creditors to negotiate

- You may receive collection calls and letters (this is normal)

- Your credit score will drop due to missed payments

- First settlements typically happen after 6-8 months

Step 4: Settlement & Payment (Ongoing)

When agreements are reached:

- The company pays creditors from your settlement account

- You pay the company’s fee (15-25% of settled amount)

- Settled accounts show as “paid-settled” on credit reports

- Process continues until all enrolled debts are handled

Step 5: Program Completion (Months 24-48)

After all debts are settled:

- You receive documentation of settlements

- You can begin rebuilding credit

- Many companies offer credit counseling to help with next steps

Critical Mistakes to Avoid When Choosing a Debt Relief Company

Mistake 1: Falling for “Too Good to Be True” Promises

Warning Signs:

- “We’ll eliminate 80% of your debt guaranteed!”

- “Fix your credit score in 30 days!”

- “Secret loophole that creditors don’t want you to know!”

Reality: No company can guarantee specific results. Creditors aren’t required to settle, and outcomes vary by situation.

Mistake 2: Paying Upfront Fees

It’s Illegal: The FTC’s Telemarketing Sales Rule prohibits debt relief companies from charging fees before settling at least one of your debts.

If a company asks for money upfront, walk away immediately.

Mistake 3: Not Understanding Total Costs

Many people focus only on the settlement fee (15-25%) but forget:

- Account setup fees ($9-10)

- Monthly maintenance fees ($9-11/month for 24-48 months = $216-528 total)

- Potential legal support fees ($20-40/month unless included)

- Tax implications on forgiven debt over $600

Example Total Cost: $20,000 enrolled debt × 20% fee = $4,000 + $10 setup + $480 maintenance (48 months × $10) = $4,490 in fees plus potential taxes on forgiven amounts.

Mistake 4: Ignoring Alternatives

Debt relief isn’t always the best option. Before committing, explore:

Debt Consolidation Loans: If you have decent credit (650+), a consolidation loan lets you pay the full amount with a lower interest rate and no credit damage from settlement.

Credit Counseling/Debt Management Plans: Nonprofit agencies negotiate lower interest rates and create payment plans with no principal reduction but also less credit damage.

DIY Negotiation: You can negotiate with creditors yourself for free—it’s time-consuming but possible.

Bankruptcy: Sometimes Chapter 7 or 13 bankruptcy is actually the better option, despite its serious consequences.

Mistake 5: Not Checking Credentials

Always verify:

- BBB Rating: Look for A+ or A ratings

- Accreditations: ACDR (Association for Consumer Debt Relief) and IAPDA (International Association of Professional Debt Arbitrators)

- State Licenses: Check your state’s requirements

- Complaint History: Review CFPB complaints and BBB complaint resolutions

Check the FTC’s Banned List: The Federal Trade Commission maintains a public list of companies and individuals banned from debt relief. Always check before signing up.

Real-World Comparison: What You’ll Actually Pay

Let’s look at three scenarios with actual numbers:

Scenario 1: $15,000 Credit Card Debt

| Company | Settlement % | Settlement Fee | Account Fees | Total Cost | Final Amount Paid |

| National Debt Relief | 50% | $1,875 (25%) | $490 | $2,365 | $9,865 |

| Money Management Int’l | 50% | $1,125 (15%) | $0 | $1,125 | $8,625 |

| Freedom Debt Relief | 50% | $1,500 (20%) | $490 | $1,990 | $9,490 |

Assumptions: 50% settlement rate, 36-month program, $10 setup + $10/month maintenance (except MMI with no account fees)

Scenario 2: $30,000 Mixed Debt (Credit Cards + Medical + Personal Loan)

| Company | Settlement % | Settlement Fee | Account Fees | Total Cost | Final Amount Paid |

| Freedom Debt Relief | 45% | $3,375 (25%) | $490 | $3,865 | $17,365 |

| Pacific Debt Relief | 45% | $2,700 (20%) | $490 | $3,190 | $16,690 |

| JG Wentworth | 45% | $3,038 (22.5%) | $490 | $3,528 | $17,028 |

The Bottom Line on Costs

While settlement can save significant money, factor in:

- Fees add 15-25% of your settled (not original) debt

- Account maintenance costs $200-500 over the program

- Tax on forgiven debt (if you forgive $15,000, expect a 1099-C form; you’ll owe taxes on that amount based on your tax bracket)

State-by-State Considerations: Where You Live Matters

Not all debt relief companies operate in every state. Here’s what you need to know:

States with Limited Options:

- Connecticut: Very few companies operate here due to strict regulations

- Oregon: Several major companies don’t serve OR residents

- Vermont: Limited availability

- West Virginia: Restricted options

States with Consumer-Friendly Regulations:

- California: Strong consumer protections and many company headquarters

- New York: Robust regulations protecting consumers

- Texas: Large market with good company availability

What This Means for You:

Always confirm a company serves your state before investing time in consultations. The companies in our top 7 list have the broadest availability, but none operate in all 50 states.

Alternatives Worth Considering Before Debt Relief

Option 1: Debt Consolidation Loans

How It Works: Take out one loan to pay off all your debts, leaving you with a single monthly payment at (hopefully) a lower interest rate.

Pros:

- No credit damage from settlement

- Pay back full amount (maintains creditor relationships)

- Fixed payment schedule

- Can improve credit over time

Cons:

- Need decent credit to qualify (usually 650+ FICO)

- Must have steady income

- Rates may not be low enough to help significantly

- Risk of accumulating new debt on paid-off cards

Best For: People with credit scores 650+ who can qualify for rates under 15%.

Option 2: Balance Transfer Credit Cards

How It Works: Transfer high-interest credit card debt to a card with 0% APR for 12-21 months.

Pros:

- No interest during promotional period

- Can save hundreds or thousands in interest

- Minimal credit impact

Cons:

- Need good credit to qualify (usually 700+)

- Balance transfer fees (typically 3-5%)

- Must pay off before promo ends or face high rates

- Limited to credit card debt only

Best For: People with good credit and the ability to pay off debt within 12-18 months.

Option 3: Credit Counseling & Debt Management Plans

How It Works: Nonprofit counselors negotiate with creditors for lower interest rates and create a structured payment plan.

Pros:

- Pay back full amount (less credit damage)

- Lower interest rates (often 6-10% vs. 20%+)

- Lower fees than settlement (often under $50/month total)

- Educational support included

Cons:

- Takes longer (typically 3-5 years)

- Must close enrolled credit card accounts

- Requires steady income to make payments

- Doesn’t reduce principal owed

Best For: People who can afford payments but need lower interest rates and structured plans.

Find Help: National Foundation for Credit Counseling (NFCC.org) connects you with nonprofit counselors.

Option 4: DIY Debt Negotiation

How It Works: You contact creditors directly to negotiate settlements yourself.

Pros:

- No company fees (save 15-25%)

- Direct control over negotiations

- Faster if you have lump sums available

- No ongoing account maintenance fees

Cons:

- Time-consuming and stressful

- Requires negotiation skills and persistence

- Same credit damage as using a company

- May not get as good settlements as experienced negotiators

Best For: Determined individuals with strong communication skills and lump sum funds available.

Your Action Plan: Next Steps to Get Started

Step 1: Calculate Your Debt-to-Income Ratio (Week 1)

Add up all monthly debt payments ÷ gross monthly income = DTI ratio

If over 50%, debt relief may be worth exploring.

Step 2: Request Free Consultations (Week 1-2)

Contact 3-4 companies from our top picks list:

- Describe your situation honestly

- Ask about expected savings and timeline

- Request total cost breakdown including ALL fees

- Get everything in writing

Questions to Ask:

- “What percentage of clients complete your program?”

- “What’s your average settlement percentage?”

- “What happens if creditors sue me during the program?”

- “Can I see a complete fee schedule, including third-party costs?”

Step 3: Explore Alternatives (Week 2)

Before committing to settlement:

- Check debt consolidation loan rates (try LendingClub, SoFi, Marcus by Goldman Sachs)

- Contact a nonprofit credit counselor (find one at NFCC.org)

- Research balance transfer offers if you have good credit

Step 4: Make Your Decision (Week 3)

Compare all options side-by-side:

- Total cost to become debt-free

- Timeline to completion

- Credit score impact

- Monthly payment affordability

Step 5: Commit Fully (Week 4 onward)

If you choose debt relief:

- Set up automatic deposits to your settlement account

- Prepare mentally for creditor calls and score drops

- Stay in close contact with your account manager

- Don’t use credit cards during the program

- Track progress monthly

Red Flags: Debt Relief Scams to Avoid

The FTC and CFPB receive thousands of debt relief complaints annually. Protect yourself by avoiding companies that:

Guarantee Results “We’ll reduce your debt by 80%, guaranteed!” — No company can guarantee specific percentages.

Charge Upfront Fees It’s illegal under federal law. Period.

Pressure You to Sign Immediately “This offer expires today!” — Legitimate companies give you time to decide.

Promise to “Fix” or “Erase” Accurate Negative Information Only inaccurate information can be removed from credit reports.

Tell You to Stop Communicating with Creditors You should be informed about creditor contacts, not cut off entirely.

Aren’t Transparent About Fees If they won’t provide a complete cost breakdown in writing, walk away.

Have Unresolved Complaints Check the BBB, CFPB, and your state attorney general’s office.

Verify Before You Trust

- Check the FTC’s banned list: ftc.gov/enforcement

- Review CFPB complaints: consumerfinance.gov

- Verify BBB accreditation: bbb.org

- Confirm state licensing: Contact your state’s consumer protection office

Frequently Asked Questions About Debt Relief

How much does debt relief cost?

Most companies charge 15-25% of your enrolled debt as their fee, plus $9-11/month for account maintenance. For example, if you settle $20,000 in debt, expect to pay $3,000-$5,000 in fees plus $200-500 in account fees over 24-48 months.

Will debt relief hurt my credit score?

Yes, significantly at first. Because programs require you to stop paying creditors, you’ll accumulate late payments and delinquencies. Expect your score to drop 100+ points initially. However, once debts are settled, you can begin rebuilding. Most people recover within 2-3 years after completing the program.

What types of debt can be settled?

Eligible: Credit cards, medical bills, personal loans, collection accounts, some business debts, certain private student loans, utility bills, repossessions

Not Eligible: Federal student loans, mortgages, car loans, child support, alimony, tax debts (though specialized companies handle these), court-ordered debts

Can creditors sue me during debt relief?

Yes. Creditors aren’t required to work with debt relief companies and may choose to sue instead. However, most creditors prefer to settle rather than pursue costly legal action. Companies like Freedom Debt Relief and New Era Debt Solutions include legal support to help if this happens.

Is forgiven debt taxable?

Yes. The IRS requires creditors to send you a 1099-C form for any forgiven debt over $600, which counts as taxable income. If $15,000 is forgiven and you’re in the 22% tax bracket, you’d owe approximately $3,300 in taxes. However, exceptions exist if you were insolvent (debts exceeded assets) when the debt was forgiven.

How long does debt relief take?

Most programs run 24-48 months. Your actual timeline depends on how much debt you have, how quickly you can save for settlements, and how willing creditors are to negotiate. The average completion time across the industry is 36-39 months.

Can I negotiate with creditors myself instead?

Absolutely. You can contact creditors directly and negotiate settlements yourself, saving the 15-25% fee. However, it requires significant time, strong negotiation skills, thick skin to handle rejection and pressure, and detailed record-keeping. Many people find the stress and time commitment aren’t worth the savings.

What’s the difference between debt relief and debt consolidation?

Debt relief/settlement: Negotiate to pay less than you owe; damages credit significantly; saves money but has consequences.

Debt consolidation: Take out one loan to pay off multiple debts; pays full amounts; minimal credit impact; simplifies payments but doesn’t reduce principal.

Are debt relief companies regulated?

Yes, at both federal and state levels. The FTC’s Telemarketing Sales Rule prohibits upfront fees and requires specific disclosures. Many states have additional licensing requirements. Look for companies accredited by the Association for Consumer Debt Relief (ACDR) and the International Association of Professional Debt Arbitrators (IAPDA).

What happens if I stop making payments to the debt relief company?

Your account will be closed, and you’ll be responsible for any debts that haven’t been settled now with additional late fees and interest. Some companies may return unused funds from your settlement account minus fees. This is why it’s crucial to ensure monthly payments are truly affordable before enrolling.

Is debt relief better than bankruptcy?

It depends on your situation;

Choose debt relief if: You have steady income, can afford monthly deposits, have primarily credit card/medical debt, want to avoid bankruptcy’s 7-10 year credit impact.

Choose bankruptcy if: You have absolutely no income, are being sued by multiple creditors, have medical debt exceeding $100,000, or need immediate legal protection. Always consult a bankruptcy attorney for personalized advice.

Final Verdict: Should You Use a Debt Relief Company?

Debt relief isn’t a magic solution, but it can be a legitimate lifeline for people in specific situations. Based on our research of 26 companies and 1,500+ data points, here’s our bottom-line recommendation:

Consider Debt Relief If You:

- Have $10,000+ in unsecured debt

- Are already behind on payments or about to default

- Can’t qualify for consolidation loans

- Want to avoid bankruptcy

- Have steady income for monthly deposits

- Understand and accept the credit score impact

Skip Debt Relief If You:

- Have good credit (700+) and can get a low-rate consolidation loan

- Can pay off debts in under 3 years with current budget adjustments

- Are judgment-proof (no income/assets for creditors to seize)

- Have mostly secured debt (auto loans, mortgages)

- Can’t afford the monthly deposit amount

- Are considering bankruptcy anyway

Our Top Recommendation

For most people, National Debt Relief offers the best combination of proven results, comprehensive services, competitive fees, and customer support. Their 34-month average completion time is 14 months faster than many competitors, and their $7,500 minimum makes them accessible to more people.

If you’re particularly worried about legal issues, Freedom Debt Relief’s included legal support and cost guarantee provide valuable peace of mind.

For those with smaller debt amounts or tighter budgets, Money Management International’s low fees (7.5-18%) and $2,500 minimum make them the most accessible option.

Take Action Today: Your Debt-Free Future Starts Now

The debt relief industry reports that clients who start programs in Q4 often complete them faster because they’re motivated by New Year financial goals. Don’t wait until you’re deeper in debt or facing lawsuits.

Your Next Steps:

- Schedule free consultations with 2-3 companies from our top picks

- Request complete cost breakdowns in writing

- Compare with debt consolidation options to ensure you’re choosing the best path

- Make an informed decision within 2 weeks

- Commit fully to the program you choose

Remember: Rates, fees, and terms change constantly. The information in this article is current as of November 2025, but always verify details directly with companies before enrolling.

Ready to Break Free from Debt?

Don’t let another month of minimum payments and mounting interest steal your financial future. The companies we’ve recommended have helped millions of Americans resolve billions in debt; you could be next.

Checking your options won’t affect your credit score and comes with no obligation.

Disclaimer: This article provides general information and should not be considered financial advice. Debt relief has significant financial and credit implications. Consult with a qualified financial advisor or credit counselor before making decisions about debt management. Company ratings, fees, and services are accurate as of November 2025 but subject to change.